Archives

Student and Advisor Networking Event 2025 sponsored by FPA NEO NexGen

/in Education Meeting, NexGen Event/by Lauren Smigelski

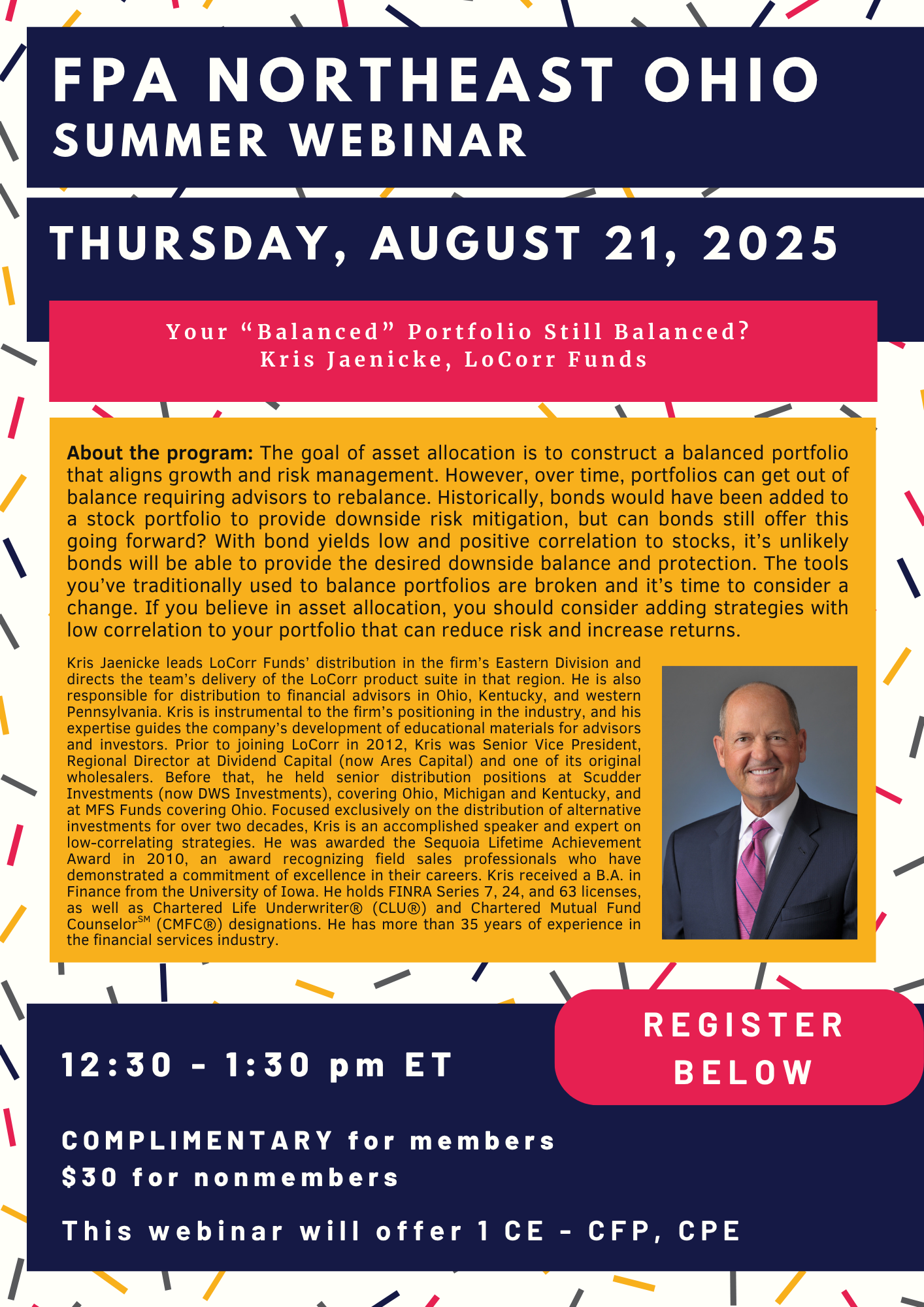

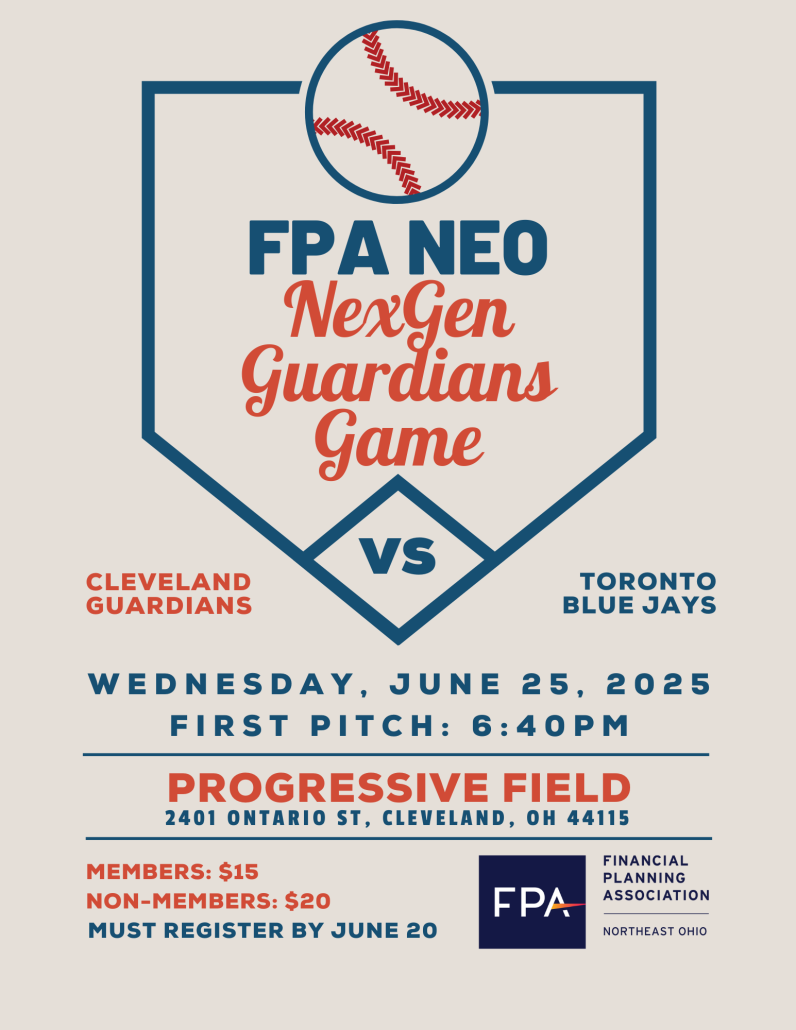

NexGen: Guardians Game 2025

/in NexGen Event/by Lauren SmigelskiRegistration for this program closed on Friday, June 20.

Winter Networking Social

/in Member Social/by Lauren SmigelskiNetwork and socialize with your fellow FPA NEO members!

Free to FPA Members

Guests $15

Includes drinks and light appetizers

May 2025 Education Meeting

/in Education Meeting/by Lauren SmigelskiFREE TO FPA MEMBERS ($65 for non-members)

TOPIC #1: Understanding Medicare and Marketplace Insurance For Your Clients

SPEAKER: Scott Prior

About the presentation: As your clients approach retirement and the milestone of turning 65, they are often filled with questions about their health insurance options. They rely on you for guidance—and this presentation is designed to equip you with the knowledge to assist them confidently. Scott Prior, owner of Priority Advisors, will clearly explain what Medicare is, how it works, and what your clients need to consider as they transition. He’ll also cover health insurance options available through the Marketplace for retirees under the age of 65, ensuring you’re prepared to add value and be a trusted resource during this critical life stage.

About the presentation: As your clients approach retirement and the milestone of turning 65, they are often filled with questions about their health insurance options. They rely on you for guidance—and this presentation is designed to equip you with the knowledge to assist them confidently. Scott Prior, owner of Priority Advisors, will clearly explain what Medicare is, how it works, and what your clients need to consider as they transition. He’ll also cover health insurance options available through the Marketplace for retirees under the age of 65, ensuring you’re prepared to add value and be a trusted resource during this critical life stage.

About the speaker: Scott Prior is the co-owner of Priority Advisors, along with his wife, Kelly Prior. Scott specializes in helping individuals, families, and small business owners make informed decisions about health insurance and Medicare planning. With over 20 years of experience, Scott serves as a trusted partner to financial planners, offering strategic insights that complement comprehensive financial plans. He guides clients through the nuances of Marketplace coverage, Medicare enrollment, and employer-sponsored benefits, ensuring healthcare choices align with long-term financial goals. Known for his educational and client-centered approach, Scott has worked with thousands of clients across Ohio. Scott is based in Northeast Ohio and collaborates with advisors to bring added value to their clients’ planning experience.

TOPIC #2: The Big Picture: Macro & Geopolitical Outlook in a Changing World

SPEAKER: Jayme E. Colosimo

About the presentation: A timely and engaging look at the macroeconomic outlook, highlighting key trends shaping markets today. We’ll cover the US economic outlook, how to think about the rising US public debt, and the latest in global geopolitics and economics. The discussion will also explore mega-trends like the potential economic implications of AI and a framework for decoding the shifting landscape of tariffs and trade policy.

About the presentation: A timely and engaging look at the macroeconomic outlook, highlighting key trends shaping markets today. We’ll cover the US economic outlook, how to think about the rising US public debt, and the latest in global geopolitics and economics. The discussion will also explore mega-trends like the potential economic implications of AI and a framework for decoding the shifting landscape of tariffs and trade policy.

About the speaker: Jayme E. Colosimo is an investment director for Capital Strategy Research and ESG at Capital Group, home of American Funds. She has 23 years of industry experience and has been with Capital Group for one year. Prior to joining Capital, Jayme was the global head of ESG and head of business advisory services, North America at Citi Global Markets. Before that, she was an economist with the Central Intelligence Agency. She holds both an MBA and a bachelor’s degree in international business from Westminster College. She is also a member of the Association of Environmental and Resource Economists and the Economics of National Security Association. Jayme is based in New York.

Continuing Education: FPA NEO will request credit for the first program, which will total two hours of CE from the CFP® Board of Standards for CFP® designation holders. A general certificate of completion and one for CPA designees who feel the program satisfies their continuing education requirements will also be available.

Reservation Policy: All attendees are encouraged to register in advance before noon 05/14/25 and walk-in reservations will be accepted on a space-available basis only. In person meeting cost is free for FPA members and $65 for non-members. If you reserve and are unable to attend, please call the office or email admin@fpa-neo.org to cancel by noon 05/14/25 to avoid a no-show reservation billing of $10.00.

About FPA-NEO

Contact Us

Lauren Smigelski

Chapter Executive

FPA of Northeast Ohio

2001 Crocker Rd., Ste. 510

Westlake, OH 44145

(216)-298-9095

admin@fpa-neo.org